Leia também: Misérias do oportunismo de esquerda [A V. Lênin in memoriam (Janeiro 1924-2014)]

Conforme adiantamos na seção anterior, constitui erro teórico primário definir imperialismo a partir da existência de “monopólios” num país capitalista qualquer. Tal argumento vem sendo utilizado por representantes de certa corrente do movimento comunista internacional (cmci) para justificar a condenação e por no alvo de ataque países capitalistas dependentes/subdesenvolvidos; bem como forças revolucionárias internas. De desenvolvimento médio ou mesmo pequeno, esses países seriam integrantes duma cadeia ou “pirâmide imperialista”, similarmente aos países do núcleo central do estágio imperialista do capitalismo global. A diferença seria hierárquica, de “graus”, mas todos eles se encontrariam num determinado estágio do imperialismo dessa pirâmide.

Para justificar a falsidade conceitual entre monopólios, e as implicações gerais do estágio imperialista do capitalismo, Lênin – dizem porta-vozes dessa cmci -, em “O Imperialismo, fase superior do capitalismo” supervalorizaria “o domínio dos monopólios”, ao ter mencionado que:

“A menos que as raízes económicas deste fenómeno sejam compreendidas e o seu significado político e social seja apreciado, nenhum passo pode ser dado para a solução do problema prático do movimento comunista”.

Assim, o Brasil ou a Grécia – possuidores de “monopólios” –, por exemplo, ali seriam enquadrados, devendo ser dessa maneira enfrentados no plano nacional e internacional. Quem não pensar e agir conforme tal “teoria” é reformista ou “oportunista” ou “revisionista”; também como o são revolucionários autênticos defensores de governos “patrióticos” no centro ou na periferia do capitalismo do estágio imperialista.

A assinalada cmci também afirma que o processo de “financeirização” da economia capitalista mundial não passa de “análise burguesa e oportunista”, que tal formulação supostamente esconderia “a essência da crise capitalista”. Que a crise atual não é “financeira” ou “estrutural”, mas sim “do capitalismo”.

Ora, que bobagem: acaso negou-se que a crise é do capitalismo, ou alguém disse por aí que a crise global dos nossos dias é do feudalismo ou do socialismo? Ouçamos, para começo de conversa, Marx:

“Deve-se distinguir bem a crise monetária, definida no texto como fase particular de cada crise geral de produção e comércio, do tipo especial de crise que se chama também de crise monetária, mas que pode parecer independentemente, de modo que ela só afeta indústria e comércio por repercussão. Estas são crises cujo movimento se centra no capital monetário e, por isso, bancos, bolsas de valores e finanças são sua esfera imediata” (Marx, Nota à 3ª edição de O Capital, Livro Primeiro, v. I, Tomo 1, São Paulo, Abril Cultural, 1983, p. 163).

Fracasso epistemológico completo

Essa pretensa ortodoxia “marxista” é inteiramente falsa: nada tem a ver com o processo de estruturação econômica originária e evolutiva do capitalismo do estágio ou fase imperialista. E simplesmente é cega à simples constatação da gigantesca hegemonia da grande finança capitalista nos dias que correm.

Como veremos, sem qualquer dúvida estamos diante de uma fraude epistemológica – ou duma teoria do desconhecimento.

O caráter da configuração de países do estágio imperialista ocorre na segunda metade do século 19 – especialmente a partir de 1870. Um grande impulso para as transformações estruturais no capitalismo concorrencial ou livre-cambista encontra-se na sinergia entre: a) a chamada 1ª Grande Depressão (1873-96), na medida em que grandes fusões e aquisições foram a saída à crise perpetrada pelo movimento do capital, particularmente na constituição de grandes bancos e corporações de grande escala produtiva; b) quando se processava então a 2ª revolução industrial, onde a eletricidade, o aço, o motor a combustão, a química da soda e do cloro, o petróleo, o telégrafo sem fio, o telefone nuclearam a transição para um capitalismo de trustes industriais diversificados e integrado através das novas descobertas científicas; ao invés de da mecânica simples e uma industrialização baseada na máquina a vapor, no ferro e no carvão.

Entretanto, deve-se sublinhar desde logo: ao requerer volume avantajado de capital para correspondência às escalas ampliadas: (i) as sociedades anônimas foram decisivas para novas estruturas das propriedades industrial ou bancária; (ii) os bancos passaram a prover crédito de capital (antes financiavam o giro dos negócios), bem como fundiram grandes empresas que passaram a ser comandadas por monopólios financeiros, cada vez mais gigantescas. É exatamente daí que – já – nascem os oligarcas das finanças: o capitalista “tocador de obra” é subordinado ao movimento de concentração e centralização do capital.

Ou nas preciosas palavras de Marx:

“O crédito que, em seus começos, desliza-se e insinua-se recatadamente como tímido auxiliar da acumulação, atraindo e aglutinando em mãos de capitalistas individuais ou associados, por meio de uma rede de fios invisíveis, o dinheiro disseminado em grandes ou pequenas massas pela superfície da sociedade, logo se revela uma arama nova e temível no campo de batalha da concorrência e termina por converter-se em um gigantesco mecanismo social de centralização de capitais” (Marx, O Capital, v. 1, Fondo de Cultura, México, 1949, p. 530, apud Barbosa de Oliveira, 2003).

É por isso que os bancos passam a predominar, também enquanto sociedade por ações, assumindo a partir de então o controle do monopólio do crédito. Os “trustes do dinheiro”, significando o poder dos bancos na centralização financeira e produtiva, com dirigentes de bancos se fazendo dirigentes de grandes empresas. Claro está que as decisões de investimento, paulatinamente, são regidas por esta nova oligarquia financeira.

Capitalismo monopolista de desenvolvimento desigual, vez que entre países do centro mais industrializado diferenças de ritmos podem ser exemplificadas com o caso da Alemanha. Nela, foi necessário que o sistema bancário, bem mais desenvolvido, financiasse a própria industrialização, o que – atenção! – acontece antes da monopolização industrial.

Estruturas econômicas imperialistas: Alemanha e EUA

Na Alemanha, uma vez que o desenvolvimento capitalista é atrasado, relativamente à Inglaterra – o capitalismo originário -, seu Estado, ainda na antiga Prússia, criou a Companhia de Comércio Ultramarino (Sheeandlung), na verdade um grande banco estatal de investimento. A Companhia investia diretamente em ramos como a metalurgia, a têxtil, a mecânica, e ainda na mineração. Ademais, fornecia crédito fácil e vantajoso às empresas capitalistas a partir de associações que dirigiam investimentos em áreas estratégicas.

Mas não só isso. Eis um exemplo claríssimo do que significa a estrutura econômica dum país imperialista: o próprio Deutsche Bank (1870) começa a atuar nas Américas do Sul e Central ainda em 1887, com o nome de Banco Alemão Transatlântico, que pertencia a uma subsidiária do Deutsche Bank, o Deutsche Ueberseeische Bank (Banco Alemão Ultramarino), fundado em Berlim em 2 de outubro de 1886. A primeira filial na América do Sul foi estabelecida em Buenos Aires, Argentina. Em seguida, foram instaladas filiais no Chile (1889), no México (1902), no Peru (1905), na Bolívia (1905) e no Uruguai (1906).

De acordo com o teórico marxista Rudolf Hilferding e autor do famoso “O capital financeiro” (1909), a configuração particular do caráter monopolista-imperialista da Alemanha ocorreu essencialmente porque:

“(…) os bancos alemães tinham, desde o princípio, o dever de colocar à disposição das sociedades por ações o capital necessário, isto é, prover não somente o crédito corrente, mas também o crédito de capital”. Ademais, de maneira geral, além do fato do desenvolvimento capitalista e sua organização creditícia fazer crescer a dependência da indústria relativamente aos bancos, estes passaram a imobilizar naquela uma parte cada vez maior de seus capitais, tornando-se crescentemente “um capitalista industrial”. E afirma ele mais adiante, descrevendo o processo de consolidação hegemônica estrutural da oligarquia financeira, à medida que “O capital financeiro desenvolveu-se com o desenvolvimento das sociedades anônimas e alcança seu apogeu com a monopolização da indústria”.

Simultaneamente, há o declínio do capital comercial, “outrora tão soberbo”, e agora transformado “em um agente da indústria monopolizada pelo capital financeiro” (Hilferding, “O capital financeiro”, cap. XIV “Os monopólios capitalistas e os bancos”, São Paulo, Nova Cultural, 1985).

Importa sublinhar que – conforme ainda conclusões decisivas à compreensão do imperialismo com capitalismo da época do capital financeiro – descreve Hilferding que, setores do capital bancário na Alemanha “desde os primórdios” estavam intimamente vinculado ao desenvolvimento da indústria pesada, quedava suporte à politica protecionista implementada destacadamente em 1879 – distintamente da oposição do capital industrial e do mercantil. Assim, diferentemente do processo de desenvolvimento imperialista da Inglaterra, adepta do “livre comércio”, os “protecionistas” Alemanha e EUA:

“(…) tornaram-se modelos de desenvolvimento capitalista, quando se admite, como critério, o grau de centralização e de concentração do capital, portanto o grau de desenvolvimento dos cartéis e trustes, o domínio dos bancos sobre a indústria, numa palavra, a transformação de todos os capitais em capital financeiro” (“O capital financeiro”, cap. XXI, A transformação na política comercial, idem).

Ora, apesar da grande identidade de leis e medidas protecionistas em favor da industrialização, acontece que o processo de conglomeração do capital bancário e industrial nos EUA se deu numa forma diversa daquela da Alemanha.

O exemplo bastante aludido dessas características outras do desenvolvimento à configuração das estruturas econômicas do imperialismo norte-americano é o de John Hobson, economista liberal burguês que deu grandes contribuições para a análise do capitalismo da época dos monopólios. Por volta de 1870, nos EUA, ricaços da indústria e das ferrovias transformaram-se também em banqueiros, o que fez Hobson descrever:

“Foi assim quem construtores de trustes, como os srs. Rockfeller, Rogers, Havenemeyer e dirigentes de estradas de ferro como Harriman, Gould, Drew, ou Vanderbilt se tornaram banqueiros ou diretores de companhias de seguros, enquanto banqueiros como J. P. Morgan organizava combinações na indústria de aço e navegação e participavam em diversas diretorias de companhias ferroviárias e industriais” (Hobson, “A evolução do capitalismo moderno”, 1894, cap. O financiador, São Paulo, Abril Cultural, 1983 (atualizada da ed. 1926).

Noutras palavras e conforme assinalara pouco antes Hobson (idem, ibidem) os lucros oriundos de monopólios como do transporte ou da manufatura passaram a ser “logicamente aplicados nas áreas das finanças”, formando fundos com ampla disponibilidade de capital, associando-se a banqueiros que então exerceram controle “financeiro geral sobre os negócios” para maiores lucros.

Isso quer dizer que, se por um lado o processo e fusão e conglomeração bancário/industrial tinha por impulso inicial as empresas, de outra parte afirmava-se o papel dos bancos como principal para o processo de centralização de capitais. Na verdade, acentuava-se a disputa pelo controle dos bancos por empresários ávidos para a manipulação do crédito contra a concorrência. (ver: “Processo de industrialização. Do capitalismo originário ao atrasado”, de C.A. Barbosa de Oliveira, São Paulo, Unesp, 2003, p. 239).

Assim, a denominada Corporation americana emerge por volta dos anos 1880, notadamente a partir da aceleração do movimento de concentração e centralização do capital, principalmente via: a) a indústria organizando firmas comerciais em escala nacional e, às vezes internacional; b) com as fusões de empresas industriais e cadeias comerciais. Mas esse processo da fusão do capital bancário com o industrial ocorre recorrendo-se ao mercado de capitais como financiador.

Hobson, em Imperialism: a study (1902), por sua vez, discorre sobre o amplo favorecimento à indústria norte-americana por tarifas protecionistas (têxtil, metalúrgica, ferramentas, vestuário, mobiliário e outros manufaturados), como motor à passagem “da infância à maturidade” – rapidez sem precedentes, afirma – possibilitou enquanto “forças propulsoras do imperialismo” a economia industrial mais bem equipada e mais produtiva do mundo. Noutras palavras:

“Um era de competição predatória, seguida por um rápido processo de fusões. Lançou uma quantidade enorme de riqueza nas mãos de um pequeno número de capitães da indústria” (Hobson, cap. VI, A principal raiz econômica do imperialismo, in: “Utópicos, heréticos e malditos”, Teixeira, A. (org.), Rio de Janeiro, Record, 2002).

Do “imperialismo” brasileiro – e da estupidez

O imperialismo, sobre o qual já caracterizamos a partir de Lênin no artigo anterior, antes de seu caráter guerreiro –“inevitavelmente”, escreveu o revolucionário russo -, não pode ser analisado levianamente, inspirado em formulações grosseiras, idealistas e anti-dialéticas.

Como é sabido por todos, a globalização neoliberal – “nova vulgata planetária”, recorda o marxista Jean Salem a Bordieu-Wacquant (2000) – comandada pelas potências imperialistas do nosso tempo ampliou significativamente as assimetrias constitutivas do desenvolvimento desigual do capitalismo; e multiplicou mais ainda as desigualdades sociais com base na exploração capitalista.

Fundamentalmente, o controle do padrão tecnológico difundido pela revolução técnico-científica atual acentuou-se, tanto do ponto de vista comércio exterior e dos organismos internacionais que decidem quem pode ou não ter a ele acesso (OMC, OCDE, BIS, FMI, Banco Mundial etc.), como sob a indiscutível hegemonia avassaladora do grande capital financeiro, aumentaram tais distâncias do próprio desenvolvimento capitalista, inclusive no interior de países centrais (regiões, cidades etc.).

Especialmente com a internacionalização e liberalização global dos mercados financeiros (“financeirização global”) e dos grandes monopólios, sob comando do dólar e da política monetária norte-americana, países como Brasil perderam a capacidade de acionar sua própria politica econômica o a autonomia em gerir sua economia.

Essencialmente, o país regrediu, do ponto de vista de sua estrutura produtiva, em relação a seu passado capitalista nacional-desenvolvimentista (1930-80). Chamou-se a isto então de “especialização regressiva”, fenômenos que destacaremos adiante.

E, muito diferentemente dos países do capitalismo central, a industrialização brasileira só é impulsionada a partir da revolução burguesa de 1930. Ainda assim, permaneceu “restringida” até os fins dos anos 1970, para completar a fase “pesada” da industrialização, iniciada entre 1956-61. Diz-se, portanto, que o Brasil atravessou cerca de 100 anos (!) para constituir um padrão capitalista, em termos de estrutura econômica, similar ao do final do século 19 dos países do núcleo duro do imperialismo (EUA, Inglaterra, Alemanha, França, Japão e Itália, particularmente).

Ora, no Brasil não houve nada parecido como processo de fusão entre o capital bancário e industrial, datada da segunda metade do século 19, que alcançaram alguns países, como demonstramos acima. Bancos, Holdings, Empreiteiras aqui existentes são grandes monopólios, sem qualquer dúvida; eles podem existir em um país capitalista determinado – e inclusive exportar capitais, por suposto. Novamente, e como vimos à exaustão, no estágio imperialista do capitalismo “o buraco é mais embaixo”, usando de nosso conhecido ditado popular.

Por conseguinte, desnecessário prosseguir quaisquer em outras tentativas ou exercícios de desvendamento acerca da teoria do “imperialismo” brasileiro ou de que o Brasil faz parte da “cadeia da pirâmide imperialista”. Apenas o devaneio ideologizado pode assim interpretar um país capitalista de desenvolvimento médio (sofisticado em algumas poucas áreas), dependente tecnologicamente, embora provedor de alguns nichos especializados importantes (aviação regional, tecnologia agrícola, petróleo em águas profundas).

Desnecessário mas útil: desde que se constituiu enquanto forças produtivas capitalistas típicas, nosso país é defensor da paz, o que continua a fazer nos fóruns internacionais, gerar geral contra o belicismo imperialista. Vulnerável e frágil do ponto de vista militar, esse imenso e continental país, de enormes fronteiras, não conseguiu ainda construir seu aparato de dissuasão estratégica. Trata-se, além, de estupidez política propagandear ser o Brasil imperialista, “semi” ou coisa que o valha!

Diametralmente oposto à afirmação do nosso país ser “imperialista”:

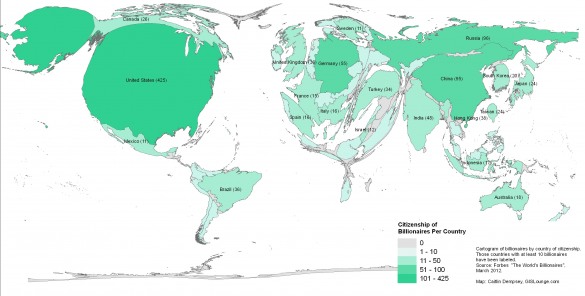

1) o Brasil continua sendo amplamente exportador de produtos primários. Embora nos últimos anos o Brasil tenha se beneficiado de circunstâncias econômicas externas e internas especialmente favoráveis, economistas ocorreu a alta e crescente participação de commodities, produtos primários, na matriz de exportação brasileira. Quase metade (48%) dela é composta por produtos in natura (principalmente produtos agropecuários, minérios, petróleo, gás e madeira). Ou seja, para além, uma pauta de exportação muito vulnerável a variações nos preços internacionais e ao padrão de consumo de outros países.

Comparativamente, observe-se a diferença qualitativa: na China (onde a participação dos produtos intensivos em recursos naturais é de apenas 9,3%), os Estados Unidos (15%), México (23%) ou Índia (29%) – há um equilíbrio entre esses produtos e os de valor agregado em tecnologia. Ademais, a participação de commodities em todo o comércio mundial é de apenas 26%, média bastante inferior ao percentual do Brasil.

A chamada “reprimarização” da pauta de exportação do Brasil já é um fato, de acordo com o Instituto de Pesquisa Econômica Aplicada (Ipea, do Ministério de Assuntos Estratégicos): entre 2007 e 2010, a participação de commodities na pauta de exportações brasileiras saltou de 41% para 51%, depois de ficar em torno dos 40% durante todos os anos 1990.[veja-se detalhadamente no gráfico abaixo]

2) Ao lado de prosseguir no caminho acima apontado, nos últimos três anos, o Brasil – e todos os outros países dependentes, subdesenvolvidos e periféricos – continua submetido à ditadura da oligarquia financeira internacional, bem ao contrário do que imagina a referida cmci, ao negar os processos objetivos, também avassaladores de amplo domínio do capitalismo contemporâneo movido pelas finanças (“financeirização”).

Totalmente diferente da tergiversação dessa cmci, como demonstra magistralmente o excelente estudo de Peter Phillips e Brady Osborne (original em: http://www.globalresearch.ca/exposing-the-financial-core-of-the-transnational-capitalist-class/5349617), [1] é quase inacreditável o gigantismo tentacular em que transfigurou-se a hegemonia do capital financeiro, suas relações apodrecidas com a lavagem do dinheiro, com o narcotráfico internacional, o contrabando de armas e todo o tipo de negócios ilegais.

Enquanto isso, o Brasil considerado “imperialista” possui hoje um PIB (Produto Interno Bruto) de 2,253 trilhões de dólares (2012): bem inferior aos valores administrados pelos conglomerados financeiros Black Rock (britânico), ou praticamente igual aos dos UBS (suíço), Allianz (alemão) ou Vanguard group (EUA)!

Em tempo: o desenvolvimento do capitalismo da etapa imperialista comprovou, assim, a conhecida formulação de Lênin (“O imperialismo, etapa superior do capitalismo”): a forma financeira do capital submeteu todas as outras ao pretérito.

As 35 principais firmas de administração de ativos do mundo, em trilhões de dólares [The World’s Top 35 Asset Management Firms, in Trillions of Dollars (2012)]

1 BlackRock US $3,560

2 UBS Switzerland $2,280

3 Allianz Germany $2,213

4 Vanguard Group US $2,080

5 State Street Global Advisors (SSgA) US $1,908

6 PIMCO (Pacific Investment Management Company) US $1,820

7 Fidelity Investments US $1,576

8 AXA Group France $1,393

9 JPMorgan Asset Management US $1,347

10 Credit Suisse Switzerland $1,279

11 BNY Mellon Asset Management US $1,299

12 HSBC UK $1,230

13 Deutsche Bank Germany $1,227

14 BNP Paribas France $1,106

15 Capital Research and Management Company US $1,071

16 Prudential Financial US $961.0

17 Amundi France $880.0

18 Goldman Sachs Group US $836.0

19 Wellington Management Company US $719.8

20 Natixis Global Asset Management France $710.9

21 Franklin Resources (FranklinTempleton Investments) US $707.1

22 Northern Trust US $704.3

23 Bank of America US $682.2

24 Invesco US $646.6

25 Legg Mason US $631.8

26 Nippon Life Insurance Company Japan $600.0

27 Legal & General Investment Management UK $598.5

28 Generali Group Italy $581.5

29 Prudential UK $570.2

30 Ameriprise Financial US $543.6

31 T. Rowe Price US $541.7

32 Wells Fargo US $534.9

33 Manulife Financial Canada $513.8

34 Sun Life Financial Canada $496.3

35 TIAA-CREF US $481.0

NOTA

[1] O excelente e confiável trabalho dos professores P. Phillips e B. Osborne está também traduzido em resistir.info (“Desvendar o núcleo financeiro da classe capitalista transnacional – os 161 indivíduos do topo”, 13/9/2013). Abaixo, a lista (importantíssima) dos 161 burgueses mais ricos e poderosos do planeta, suas vinculações e funções, que fiz questão de reproduzir do original, em inglês.

Appendix

Citizenship, CB-Corporate Boards, PE-Prior Corporate Employment/Boards, PC-Policy Councils & Government, E-Universities N=161

Barclays PLC (Assets $2.4 Trillion)

Antony Peter Jenkins, UK, CB-Group Chief Executive, Barclays PLC, PE-Citibank, Visa Europe Ltd, Absa Group Limited, PC-World Economic Forum-2013, Chartered Institute of Bankers, British-American Business—International Council, E-Oxford University, Cranfield Institute of Technology-MBA

Sir David Alan Walker, UK, CB-Chairman, Barclays, PE-International Monetary Fund, Bank of England, CEGB, Reuters Venture Capital, Morgan Stanley, Lloyds Bank, PC- World Economic Forum-2013, Group of Thirty (G30), London Investment Bankers’ Association, Assistant Secretary at the Treasury, The Financial Services Authority (FSA) UK, E-Queens College-MA Economics, Cambridge,

Frits van Paasschen, US, CB-CEO Starwood Hotels and Resorts Worldwide, Inc., PE-Coors Brewing Company-CEO, Nike Inc., Disney Consumer Products. Jones Apparel Group Inc., Oakley Inc., FPaasschen Consulting, Mercator Investments, McKinsey & Company, Boston Consulting Group, PC-World Economic Forum-2013, E-Amherst College, Massachusetts, Harvard Business School-MBA

Michael Ashley, UK, CB-KPMG Europe LLP (‘ELLP’), Deloitte Touche Tohmatsu Limited, The Financial Reporting Council Limited, PC-Institute of Chartered Accountants in England and Wales, HM Treasury’s Audit Committee, European Financial Reporting Advisory Group,

Hugh E. “Skip” McGee III, US, PE-Lehman Brothers Holdings Inc., CIB Americas, E- Princeton, University of Texas School of Law-JD

Tim Breedon, UK, CB- Index Funds PE-Legal & General Group plc, Standard Charter Bank, Mithras Investment Trust plc. PC-Association of British Insurers (ABI) UK Government’s non-bank lending taskforce, Investment Management Association, Ministry of Justice. E-Oxford University, London Business School-MS-Business

Fulvio Conti, Italy, CB-CEO-Enel SpA, RCS MediaGroup, ENDESA SA, AON PLC, Eurelectric, Trasmissione Elettricita Rete Nazionale SPA, PE-Telecom Italia SpA, Montedison-Compart, Montecatini. Mobil Oil, Wind Telecomunicazioni SpA, PC-World Economic Forum-2013, Confindustria-Italian Employers’ Federation, E- University of Rome La Sapienza,

Ashok Vaswani Brysam, India, CB-Brysam Global Partners, PE-Citibank, Consumer Bank, US Cards Business, PC-S. P. Jain Institute of Management Singapore, E-Bombay University, Sydenham College of Commerce and Economics- Institute of Chartered Accountants of India

Diane de Saint Victor, French, CB-ABB Limited, Baldor Electric Co., PE-EADS, SCA Hygiene Products, Honeywell International, General Electric, Thales, Lyon-Caen, Fabiani & Thiriez, PC-International Bar Association, E- Pantheon-Assas University, Paris Law School-JD,

Shaygan Kheradpir Ph.D., UK, PE-Verizon Communications, GTE PC-National Institute of Standards & Technology E-Cornell University-Ph.D. Electrical Engineering,

David George Booth, US, CB-East Ferry Investors Inc., PE-Morgan Stanley, Discount Corporation of New York E-University of Kansas, University of Chicago-MBA

Simon John Fraser, UK, CB-Fidelity International, Fidelity European Values PLC, Fidelity Japanese Values PLC., Ashmore Group Plc. H. Lundén Kapitalförvaltning AB, The Edinburgh Investment Trust Plc, PE-FIL Investments International, Investment Solutions Group Ltd. E-University of St. Andrews, Columbia University-MBA

Reuben Jeffery III, US, CB-CEO of Rockefeller & Co, PE-US Under Secretary of State for Economic, Energy and Agricultural Affairs, Goldman Sachs & Co, Davis Polk & Wardwell, Morgan Guaranty Trust Company, PC-National Security Council, Council on Foreign Relations, World Economic Forum, Center for Strategic & International Studies in Washington DC, Commodity Futures Trading Commission, International Advisory Council of the China Securities Regulatory Commission (CSRC), E-Yale University, Stanford University-JD,

Dambisa Moyo, Ph.D., Zambia, CB- SABMiller PLC, Barrick Gold Corporation, Lundin Petroleum AB, PE-World Bank, Goldman Sachs, PC-World Economic Forum, Bilderberg Group, E-St Antony’s College, Oxford-Ph.D., Harvard-Kennedy School of Government-MPA, American University-MBA

Sir Michael Rake, UK, CB-BT Group PLC, easyJet PLC., PE-KPMG International, McGraw-Hill Companies, PC-World Economic Forum-2013, The Prince of Wales’s Charitable Foundation, Chatham House-Royal Institute of International Affairs, British-American Business—International Council, Confederation of British Industry, UK- Department of Trade and Industry, International Business Leaders Forum, Oxford Advisory Board, E-Wellington College

Sir John Sunderland, UK, CB-Chancellor of Aston University, Merlin Entertainments Limited, AFC Energy plc., PE-Cadbury Schweppes PLC, CVC Capital Partners, PC- Confederation of British Industry, Financial Reporting Council, Chartered Management Institute, Business in the Community, Governor of Reading University, E-University of St. Andrews.

Maria Ramos, South Africa, CB- Absa Group Ltd, PE-Transnet Limited PC- Director-General of the National Treasury, Business Trust (South Africa), International Business Council, World Economic Forum-2013, World Bank Chief Economist Advisory Panel, Business Leadership South Africa, Banking Association of South Africa, E-University of the Witwatersrand (Wits), University of London-MS, Fortune-World’s 50 Most Powerful Women in Business

BlackRock Inc. (Inc. Assets $22.3 billion)

Assets in management: $3.7 trillion

Laurence Fink, US, CB- PNC Financial Services Group Inc., Innovir Laboratories Inc., York Stock Exchange, Inc., PE-The First Boston Corporation, VIMRx Pharmaceuticals Inc., E-University of California Los Angeles, Awards-CEO of the Decade-Financial News 2011

Robert S. Kapito, US, CB-icruise.com, PE-Bain & Co ,PC- Trustee, University of Pennsylvania, International Monetary Conference, The Financial Services Roundtable, E- Harvard Business School-MBA, Wharton School of the University of Pennsylvania.

James Rohr, US, CD-CEO, PNC Bank, EQT Corporation (Equitable Resources Inc.) Mercantile Bankshares Corp., PC-Trustee of Carnegie Mellon University, The RAND Corporation, Federal Reserve Bank of Cleveland, Bohemian Club, E-Notre Dame, Ohio State-MBA,

Hsueh-Ming Wang, Taiwan, PE-Goldman Sachs, The Paulson Institute

Murry S. Gerber, US, CD-Halliburton, United States Steel Corp, PE-CEO of EQT, Corporation, Shell Energy North America, PC-Pennsylvania Business Council, Trustee-Augustana College, E-Augustana College, University of Illinois-MA Geology

Thomas H. O’Brien, Jr., US, CB-CEO-PNC, McMahon Capital Advisors, LLC, PNC Financial Services Group Inc., US Airways Group Inc, Confluence Technologies Inc., Verizon New England Inc., Porcelain Industries Inc., HMR Acquisition Company Inc., Cavert Wire Company Inc., Viasystems Inc., PE-Pittsburgh National Bank, Hilb Rogal & Hobbs, Westinghouse Credit Corp. Co, PC-Trustee of University of Pittsburgh. E-Boston College, University of Notre Dame, Harvard-MBA, University of Pittsburgh

Sir Deryck Charles Maughan, UK, CB-Kohlberg Kravis Roberts & Co., Nikko Securities Co., Glaxosmithkline PLC, Thomson Reuters Corporation, PE-Salomon Brothers Inc., The Goldman Sachs Group Inc., Salomon Smith Barney, Citicorp., PC- Trilateral Commission, British American Business Inc. British-American Business Council, New York Stock Exchange, Advisory Councils at Harvard and Stanford Universities, E- King’s College, University of London, Graduate School of Business, Stanford University-MS

David Komansky, US, CD-Fieldpoint Private Bank & Trust, AEA Investors LP, AEA Investors LLC, Burt’s Bees, Discover Financial Services, Schering-Plough, PE-BofA Merrill Lynch, Pierce, Fenner & Smith Incorporated, EP Technologies, Inc., Automated Security (Holdings) PLC., New York Stock Exchange, NYSE Euronext, Inc., WPP Group PLC, PC-British American Business Council, Trustee of Tsinghua University in Beijing, E-University of Miami

James Grosfeld, US, CB-Copart, Inc. Interstate Bakeries Corporation, Addington Resources Inc., PE-Pulte Homes, Inc., Championship Liquidating Trust, PC- Federal National Mortgage Association, E-Amherst College, Columbia Law School-JD

William S. Demchak, CB-CEO-PNC Financial Services Group Inc., Hilliard Lyons Research Advisors, The RBB Fund, Inc. Senbanc Fund, PE-J.P. Morgan Chase & Co., PC-World Affairs Council of Pittsburgh, The Financial Services Roundtable, E- Allegheny College, University of Michigan-MBA

Susan Lynn Wagner, US, CB- RBB Fund, Inc.. Bogle Small Cap Growth Fund, Director of DSP BlackRock Investment Managers, India, PE-Lehman Brothers, Founding Partner BlackRock, E-Wellesley College, University of Chicago-MBA Finance

Dennis D. Dammerman, US, CB-Capmark Financial Group, Inc., General Electric Capital Corp., Swiss Re Ltd., PE-Kidder Peabody Group Inc., Montgomery Ward Holding Corp., Genworth Financial Inc., PC-Trustee of Skidmore College, E-University of Dubuque.

Mathis Cabiallavetta, Swiss, CB-Union Bank of Switzerland, Swiss Re Ltd, Philip Morris International, Inc., General Atlantic Partners, Altria, PE-Marsh & McLennan Companies, Inc., PC-US Federal Reserve, Swiss American Chamber of Commerce, British-American Business Council, E-University of Montreal, Queen’s University, Kingston-MA-Economics, Ontario,

Abdlatif Al-Hamad, Kuwait, PD-Morgan Stanley, Marsh & McLennan Companies, Inc., American International Group, Inc., National Bank of Kuwait, PC-Arab Fund for Economic and Social Development, Arab Planning Institute, Banking Advisory Board Group (World Bank), Minister of Finance and Minister of Planning of Kuwait, United Nations Committee for Development Planning, Commission on Global Governance, E-Claremont College, Harvard International Affairs Program,

John Silvester Varley, UK, CB-CEO-Barclays PLC, British Grolux Investments Limited, Rio Tinto Ltd. & Rio Tinto Plc, Astrazeneca PLC, PC-International Advisory Panel of the Monetary Authority of Singapore, Trustee-Prince of Wales’s Charitable Foundation, E- Oriel College, Oxford, London’s College of Law.

Ivan Seidenberg, US, CB-Perella Weinberg Partners LP, PE-CEO-Verizon Communications, Cellco Partnership, Inc., American Home Products Corporation, Wyeth, LLC Honeywell Technology Solutions, Viacom, PC-Chairman of Business Roundtable, New York Academy of Sciences, President’s Export Council for U.S., E-City University of New York, Pace University-MBA,

Thomas Montag, US, CB-Bank of America Corporation/Merrill-Lynch, GS Financial Products, PE- Goldman Sachs Group Inc., First National Bank of Chicago, PC-World Economic Forum-2013, The Partnership for New York City, Director of Securities Industry and Financial Markets Association, E-Stanford University, Northwestern University-MBA,

Marco Antonio Slim Domit,* Mexico, CB-CEO-Grupo Financiero Inbursa, S.A.B. de C.V, Impulsora del Desarrollo y el Empleoen America Latina, S.A.B. de C.V, Impulsora del Desarrollo y el Empleoen America Latina, S.A.B. de C.V, Afore Inbursa, S.A. de C.V., Arrendadora Financiera Inbursa, S.A. de C.V., Operadora Inbursa de Sociedades de Inversion, S.A. de C.V., Seguros Inbursa, S.A., Sears Roebuck, America Telecom, America Movil, S.A. the C.V., Carso Global Telecom S.A. de CV., U.S. Commercial Corp., S.A. the C.V., CompUSA and Grupo Carso S.A. de C.V. PE-Director of Telefonos de Mexico, S.A.B. de C.V, E-Universidad Anahuac, *Son of Carlos Slim Helú rated as richest person in the world by Forbes Magazine—estimated wealth $70 billion.

Fabrizio Freda, Italy, CB-CEO-The Estée Lauder Companies Inc., PE-Procter & Gamble Company, P&G/The Coca-Cola Company LLC, E-University of Naples,

Jessica P. Einhorn, Ph.D., US, CB-Dean at Paul H Nitze School of Advanced International Studies of the Johns Hopkins University, Time Warner Inc., PE-Clark & Weinstock, International Monetary Fund, World Bank, United States Treasury, United States State Department, International Development Cooperation Agency of the United States, Pitney Bowes Inc., PC-Trilateral Commission, Council on Foreign Relations, Trustee for the Rockefeller Brothers Fund., Peterson Institute for International Economics, Center for Global Development, National Bureau of Economic Research, E-Barnard College at Columbia University, SAIS-John Hopkins-MA, Princeton University-Ph.D. Political Science

Capital Group Companies Inc.

Assets Management: $1.07 Trillion

David Isador Fisher, US, CB-Colonial First State (FirstChoice), Capital International Global Share, Capital Guardian and Trust Company, AEGON/Transamerica Series Trust-Capital Guardian Global Portfolio, JNL Series Trust-JNL/UBS Large Cap Select Growth Fund, Vantagepoint Growth & Income Fund, Pacific Select Fund-Equity Portfolio; John Hancock Trust-Overseas Equity Trust, PE-Smith Barney & Co, General Electric Company, PC-International Monetary Fund Retirement Plan, Monetary Authority of Singapore, Trustee-Lowe Institute, Harvard-Westlake School, Claremont McKenna College, UCLA School of Public Policy and Social Research, E-University of California at Berkeley, University of Missouri-MBA,

Martin E. Diaz Plata, Columbia, CB-Managing Partner Capital Group, PE-Donaldson, Lufkin & Jenrette (now Credit Suisse), DLJ Merchant Banking Partners, Corporacion Financiera del Valle in Bogota E-Universidad Externado de Colombia, Columbia University Graduate School of Business-MBA

Ashley Dunster, Australia, CB-Managing Partner Capital Group, PE-European Bank for Reconstruction and Development, L|E|K Partnership, E-University of Melbourne, Oxford University

Koenraad Foulon, Belgium, CB-Managing Partner Capital Group, PE-Shearson Lehman Global Asset Management, Posthorn Global Asset, Morgan Guaranty Trust Company Banque DeGroof in Brussels, E-University of Louvain, Belgium.

Shaw B. Wagener, US, CB-Capital Group International, Capital Guardian Trust Company, PC-Los Angeles Society of Financial Analyst, E-Claremont McKenna College

Leonard L. Kim, Singapore, CB-Managing Partner Partner Capital Group, PE-Peregrine Capital Limited, Kimbaco Limited-Korea, The First Boston Corporation, E-Stanford University

Guilherme Lins, Brazil, Managing Partner Capital Group, PE-JPMorgan, Matuschka Group, E-Universidade Federal do Rio de Janeiro, École des Hautes Études Commerciales-HEC

Lam Nguyen-Phuong, Vietnam (US), CB-Managing Partner Capital Group, PE-Ermgassen & Co. Ltd, JP Morgan & Co., RepublicBank Dallas. École Centrale (Paris, France), Stanford University-MBA

FMR Corporation: Fidelity Worldwide Investment (Family Controlled)

Assets Management: $1.7 Trillion

Edward Crosby Johnson III, US, CB-CEO-Fidelity, Trustee of Fidelity Commonwealth Trust, FMR Corp, ARI Holdings Inc., Greenery Rehabilitation Group Inc., Premier BanCorp Inc, Crocker Realty Investors Inc, Dr. Solomon’s Group PLC, and ForSoft Ltd., Regal Communications Corp., E-Harvard,

Abigail Pierrepont Johnson, US, CB-President-Fidelity Financial Services, L.L.C. PE-Booz Allen & Hamilton, PC-Trustee of Fidelity Commonwealth Trust, Massachusetts Institute of Technology, E-Hobart and William Smith Colleges, Harvard Business-MBA

Ned C. Lautenbach, US, CB-Clayton, Dubilier & Rice, Inc., PE-IBM, Covansys Corp., Acterna Corp., Providian Corp., Eaton Corp., Italtel Holding S.p.A, Axcelis Technologies Inc., Sony Corp., PC-Council on Foreign Relations, Trustee of Fairfield University, University of Cincinnati Foundation, Board of Governors State University Florida, E- University of Cincinnati, Harvard Business-MBA,

AXA

Assets Management: $1.4 Trillion

Claude Bébéar, France, CB-Honorary Chairman of AXA, Vivendi, BNP Paribas, Schneider Electric, PC-Institut Montaigne, E-Institute of Actuaries of France

Henri de Castries, France, CB-CEO-AXA, Nestlé, PE-French Treasury Department, Rhône-Poulenc Group, E-Ecole des Hautes Etudes Commerciales,

Norbert Dentressangle, France, CB-Financière Norbert Dentressangle, Dentressangle Initiatives (SAS) (formerly Financière de Cuzieu (SAS)), ND Investissements (SAS), SEB SA, Vivendi, SOFADE. PE-FINAIXAM.

Jean-Pierre Clamadieu, France, CB-Solvay, Rhodia. Faurecia, SNCF, PE-Ministry of Labour, PC-World Economic Forum 2013, Franco-Brazilian Business Council, Int’l MEDEF. European Chemical Industry Council. Member, Int’l Chemical Industry Council; E-Ecole Nationale Supérieure des Mines of Paris, Ingénieur du Corps des Mines, Awards: National Order of Merit, 2009,

Denis Duverne, France, CB-MONY Life Insurance Company, PE-Corporate Taxes Department for the French Ministry of Finance, Compagnie Financière IBI., Banque Colbert, E-École des Hautes Études Commerciales (HEC), École Nationale d’Administration (ENA),

Jean-Martin Folz, France: CB-Eutelsat Communications,. Compagnie de Saint-Gobain, ONF-Participations (SAS), Société Générale, Solvay (Belgium), PE-Peugeot SA E-École Polytechnique and ingénieur des Mines

Anthony Hamilton, UK, CB-MONY Life Insurance Company (United States), Tawa plc (United Kingdom), Binley Limited (United Kingdom), Swiss Re Capital Markets Limited (United Kingdom) PE- Schroders, Morgan Grenfell, and Wainwright, Fox-Pitt & Kelton, PC- The Game & Wildlife Conservation Trust (United Kingdom), E-Oxford University

Isabelle Kocher, France, CB-Arkema, Suez Environnement, International Power Plc (IPR) (United Kingdom), PE-GDF SUEZ., PC-Advisor on Industrial Affairs of the French Prime Minister Office, E-Ecole Normale Supérieure, Rue d’Ulm, Paris, France; Engineer of the Corps des Mines; DEA (postgraduate degree) in quantum optics and aggregation in Physics

Suet Fern Lee, Singapore, CB-Stamford Law Corporation (Singapore), Sanofi, Macquarie International Infrastructure Fund Ltd (Bermuda), Rickmers Trust Management Pte Ltd (Singapore), Nanyang Technological University, National University of Singapore Business School, PE-IPBA (Singapore), China Aviation Oil, Corporation Limited, ECS Holdings Limited, Richina Pacific Limited (Bermuda), SembCorp Industries Limited (Singapore), Sincere Watch (Hong Kong) Limited (Hong Kong), Transcu Group Limited, E-Cambridge University-Law

Stefan Lippe, German, CB-German Insurance Association for Vocational Training (BWV) (Germany), Acqupart Holding AG, Acqufin AG., Extremus Insurance Ltd. PE- Bavarian Re., Swiss Re., PC-World Economic Forum, E-University of Mannheim,

François Martineau, France, CB-SCP Lussan & Associés, Associations Mutuelles Le Conservateur, Bred Banque Populaire, Ecole Nationale de la Magistrature (ENM), PE- Law and Political Sciences School of Lima , Peru, PC-Council of Europe, Law Consultant Eastern Europe,, E-University Paris IV (Philosophy Degree), University Paris I (Law Master), l’Institut d’Études Politiques de Paris,

Deanna Oppenheimer, US-UK, CB-CameoWorks, NCR Corporation, Tesco PLC (UK) PE-Washington Mutual, Barclays, Catellus, Plum Creek, E-University of Puget Sound, Kellogg School of Management at Northwestern University

Ramon de Oliveira, France, CB-Investment Audit Practice, LLC, JACCAR Holdings SA (Luxembourg), MONY Life Insurance Company, Quilvest (Luxembourg), Taittinger-Kobrand, PE-Logan Pass Partners LLC, Kauffman Foundation, American Century Company, Inc., JP Morgan, SunGard Data Systems, The Hartford Insurance Company, The Red Cross, E-University of Paris, Institut d’Études Politiques (Paris)

Michel Pébereau, France, CB-BNP Paribas, Compagnie de Saint-Gobain, Total, Banque Marocaine pour le Commerce et l’Industrie (BMCI) (Morocco), BNP Paribas SA (Switzerland), EADS N.V. (Netherlands), Pargesa Holding S.A. PE-Crédit Commercial de France, BNP Paribas, PC-Conseil d’Orientation de l’Institut de l’Entreprise, Aspen Institute, Fédération Bancaire Européenne, Institut de l’Entreprise, Lafarge, E-École Polytechnique, École Nationale d’Administration (ENA).

Dominique Reiniche, France, CB-ECR Europe (Belgium), PE-The Coca-Cola Company Europe, Procter & Gamble, PC-MEDEF (French Employer Federation), UNESDA (Union of European Beverages Associations) (Belgium), Vice-Chairman, FDE (Food & Drink Europe) E-ESSEC Business School in Paris

Marcus Schenck Ph,D,. Germany, CB- E.ON AG (Germany), Commerzbank AG (Germany), SMS Group GmbH (Germany), HSBC Trinkaus & Burkhardt AG (Germany), PE-Goldman, Sachs & Co., oHG, McKinsey & Co, PC-Berlin Center of Corporate Governance (Germany)Capital Markets Advisory Council to the German Finance Minister (Germany) E-University Bonn, UC Berkeley, University of Cologne,

State Street Corporation

Assets management: $1.9 trillion

Joseph (Jay) L. Hooley, US, CB-President-State Street Corp., Boston Financial Data Services, National Financial Data Services, PC-Boston College Center for Asset Management, Corporate Advisory Board, The Boston Club, E-Boston College

Kennett F. Burnes, US, CB-CEO-Cabot Corporation, Watts Water Technologies, PE- Choate, Hall & Stewart, E-Harvard University BA-JD

Peter Coym Ph.D., Germany, PE-Lehman Brothers Holdings Inc., Salomon Brothers AG, Magix AG, (Börsenrat), Eurex, PC-Association of Foreign Banks, German Deposit Protection Fund, German Central Capital Market Committee, Advisor-German Bundesbank & German Minister of Finance, E-University of Hambur

Patrick de Saint-Aignan, US-France, CB-European Kyoto Fund, Allied World Assurance Company Holdings AG, PE-Morgan Stanley, IXIS Corporate and Investment, Bank of China Limited, Natixis Corporate & Investment Bank, E-Ecole des Hautes Etudes Commerciales, Harvard University-MBA,

Dame Amelia C. Fawcett, US-UK, CB- Guardian Media Group plc, Investment AB Kinnevik, PE-Morgan Stanley, Sullivan & Cromwell, Pensions First LLP, PC-Hedge Fund Standards Board, Prince of Wales’s Charitable Foundation, Governor, London Business School, Commissioner, US-UK Fulbright Commission, E-Wellesley College, University of Virginia-JD, Awards-Dame Commander of the Order of the British Empire-2010

David P. Gruber, US, CB-Stone Panels, Inc., Nanocomp Technologies Inc., PE-CEO-, Wyman-Gordon Company, Cambridge Semantics Inc., PC-Trustee, Manufacturers Alliance for Productivity and Innovation, E-Ohio State University

Linda A. Hill Ph.D., US, CB-Harvard Business School: Wallace Brett Donham Professor of Business Administration, Cooper Industries, Harvard Business Publishing, PC-Trustee, Bryn Mawr College, The Bridgespan Group, Nelson Mandela Children’s Fund USA, E-Bryn Mawr College, University of Chicago-Ph.D.

Robert S. Kaplan, US, CB-Professor of Management Practice, Harvard Business School, Berkshire Partners LLC, Indaba Capital Management, LLC, PE-Goldman Sachs Group, Bed, Bath & Beyond, Inc, PC-Harvard Management Company, Draper, Richards, Kaplan Foundation, Trustee, Ford Foundation, E-MIT-MS-Electrical Engineering, Cornell University-Ph.D.

Richard P. Sergel. US, CB-Emera, Inc., PE-CEO-North American Electric Reliability Corporation, New England Electric System (National Grid USA), PC-Director of The Greater Boston Chamber of Commerce, Consortium for Energy Efficiency, E-Florida State University, North Carolina State University, University of Miami-MBA,

Ronald L. Skates, US, CB-Raytheon Company, Courier Corporation, Gilbane, Inc., PE-CEO-Data General Corp., PricewaterhouseCoopers, Cabot Microelectronics Corp. E-Harvard, BA-MBA

Gregory L. Summe, US, CB-Global Buyout, Carlyle Group, Automatic Data Processing, Inc., PE-Goldman Sachs Capital Partners, PerkinElmer, Inc., General Aviation Avionics, AlliedSignal (Honeywell International), General Electric, McKinsey & Co. PC-Conference Board, E-University of Kentucky, University of Cincinnati, Wharton School of the University of Pennsylvania-MBA

Robert E. Weissman, US, CB-Pitney Bowes Inc., Information Services Group, Inc., Cognizant Technology Solutions Corp., Shelburne Investments, Nielsen Media Research Inc., Director of Gartner Group, Inc., EntreCap Financial LLC, PE-IMS Health Inc., of Dun & Bradstreet Corp., E-Babson College,

J. P. Morgan Chase & Co.

Assets management: $1.34 Trillion

James A. Bell, US, CB-The Boeing Company, PE-Rockwell, Dow Chemical, PC- Trustee at Center for Strategic and International Studies Inc, World Business Chicago, Chicago Economic Club, E-California State University at Los Angeles.

Crandall C. Bowles, US, Springs Industries, Inc., Deere & Company of Sara Lee Corporation, PE-Wachovia Corporation, PC-The Business Council, Trustee-Brookings Institution, Global Research institute of UNC-Chapel Hill, The Committee of 200, Economic Club of New York, The University of North Carolina Press, E-Wellesley College, Columbia University-MBA,

Stephen B. Burke, US, CB-NBCUniversal, LLC, Comcast Corporation, Berkshire Hathaway, PE-Walt Disney Company-ABC Broadcasting-President, E-Colgate University, Harvard Business School-MBA,

David M. Cote, US, CB-Honeywell International Inc., Advisor-Kohlberg Kravis Roberts & Co., PE-CEO-TRW Inc., General Electric, PC-Business Roundtable, National Commission on Fiscal Responsibility and Reform, U.S.-India CEO Forum, E-University of New Hampshire

James S. Crown, US, CB-Henry Crown and Company, General Dynamics Corporation, Sara Lee Corporation, JPMorgan Chase Bank, N.A, Bank One Corp., First Chicago NBD Corp., PE-Salomon Brothers Inc., Capital Markets Service Group, Hillshire Brands Company, PC-World Business Chicago, PEC Israel Economic Corp., The Aspen Institute-trustee, University of Chicago-trustee, E-Hampshire College, Stanford University Law School,

James Dimon, US, CB-CEO-JP Morgan Chase, PE-Citigroup Inc., Travelers Group, Commercial Credit Company, American Express Company, PC-The Federal Reserve Bank of New York, World Economic Forum-2013, Trustee-New York University School of Medicine, E-Tufts University, Harvard Business School-MBA,

Timothy P. Flynn, US, CB-Wal-Mart Stores, Inc., PE- KPMG LLP, PC-World Economic Forum’s International Business Counsel, Business Roundtable, Financial Accounting Standards Board, The Prince of Wales’ International Integrated Reporting Committee, E- University of St. Thomas, St. Paul, Minnesota,

Ellen V. Futter, US, CB-Consolidated Edison, Inc., PE- President of Barnard College, Milbank, Tweed, Hadley & McCloy, American International Group Inc., Bristol-Myers Squibb Company, Viacom, AIG Aviation Inc., CBS Inc., PC-Council on Foreign Relations, The American Ditchley Foundation and NYC & Company, Federal Reserve Bank of New York, President of the American Museum of Natural History, E-Barnard College, Columbia Law School

Laban P. Jackson, Jr., US, CB- Clear Creek Properties, Inc., Gulf Stream Home, Garden, Inc., TBN Holdings, PE-Home Depot, SIRVA, IPIX Corporation, Bank One, PC-Federal Reserve Bank of Cleveland, E-United States Military Academy

Lee R. Raymond Ph.D., US, CB-Advisor-Kohlberg Kravis Roberts & Co., Decision Sciences Corporation, PE-CEO- ExxonMobil, PC- Business Council for International Understanding, National Petroleum Council, American Enterprise Institute, Roundtable’s Policy Committee, The Business Council, The Business Roundtable, Council on Foreign Relations. President’s Export Council, National Petroleum Council, E-University of Wisconsin, University of Minnesota-Ph.D. Chemical Enginnering,

William C. Weldon, US, CB-Chairman-Johnson & Johnson, PE-Korea McNeil, Ltd, Ortho-Cilag Pharmaceutical, Ltd., Janssen Pharmaceutica, Ethicon Endo-Surgery, PC- US-China Business Council, The Business Council, Business Roundtable, Pharmaceutical Research and Manufacturers of America, E-Quinnipiac University

Legal & General Group PLC (LGIMA)

Assets management: $598 Billion

John Morrison Stewart, Australian, CB-Chairman-Legal & General Group PLC, Telstra Corporation, Court of the Bank of England, PE-CEO-Woolwich, Deputy CEO-Barclays, National Australia Bank, PC-Australian Federal Attorney General’s Business Advisory Group, Scottish Enterprise’s International Advisory Board, Australian Prime Minister’s Task Group on Emissions Trading, Business Council of Australia, E-BA, ACII and FCIB Degrees

Nigel Wilson Ph.D., UK, CB-The Capita Group plc, PE-United Business Media PLC, Halfords Group Plc, Dixons Group Plc, Guinness Peat Aviation (G.P.A.), Stanhope Properties Plc, McKinsey & Co, Deloitte Haskins & Sells,, E-Warwick University, MIT-Ph.D. Kennedy Scholar,

Mark Zinkula, US, CB-CEO-LIGMA, PE-Principal Financial Group, Cornell College, PC-Investment Management Association, E-University of Iowa, BA-MBA, London School of Economics.

Mark Gregory, UK, PE-Kingfisher Plc and ASDA. E Chartered Accountant with PwC.

John Pollock, UK, E-Strathclyde University.

Henry Staunton, UK, CB-Standard Bank Plc, The Merchants Trust Plc, New Look Retailers Limited and Capital & Counties Properties Plc., WH Smith PLC, PE-Price Waterhouse, Media Ventures at ITV plc., Box clever Technology, ITV Plc, Granada Group Plc, Ashtead Group Plc, EMAP PAP Plc, Independent Television News Limited, Vector Hospitality Plc, Ladbrokes Plc., New Look Group Limited, PC-Xfi Centre for Finance and Investment, E-Exeter University

Mike Fairey, UK, CB-Horizon Acquisition Company Plc, Vertex Data Science, Northern Rock Plc, Danske Bank AS, Vertex Group Limited,The Energy Saving Trust Limited, Lloyds TSB Group Pension Trust Ltd.-Chairman, PE-Deputy Group Chief Executive, Lloyds TSB Group Plc, Barclays Bank, Northern Rock plc, PC-British Quality Foundation, Trustee-Consumer Credit Counselling Service, E-AIB -Associate, Chartered Institute of Bankers

Rudy Markham, UK, CB-Standard Chartered Plc United Parcel Service Inc, UCL Partners Ltd, AstraZeneca Plc, Legal & General Group Plc, A Brain Co., Ltd., JohnsonDiversey Holdings, Inc., CSM nv, PE-CEO-Unilever Plc-Japan-Australia, PC- Financial Reporting Council, NHS Foundation Trust, E- Christ’s College, Cambridge University MS-Natural Sciences

Stuart Popham, UK, CB-EMEA Banking for Citigroup Inc, Legal & General Insurance, The Barbican Centre Trust, PE-Senior Partner of Clifford Chance LLP, PC- Confederation of British Industry’s (CBI), Royal Institute of International Affairs, Chairman of City UK, Advisor-Saïd Business School-University of Oxford, Council of the RNLI, Birkbeck University of London, Member of Chatham House, London Council of the CBI-Chair, E Southampton University-Law

Nick Prettejohn, UK, CB- Brit Insurance Limited, Legal & General Group Plc, Egg Plc., Brit Insurance Holdings N.V. PE-Chief Executive of Lloyd’s of London, CEO-Prudential UK & Europe, Prudential Plc., Bain and Company, Director of Anglo & Overseas PLC, PC-Oxford Union Society, Financial Services Practitioner Panel, E- Taunton School, Somerset, Balliol College, Oxford

Julia S. Wilson, UK, CB-3i Group plc, PE-3i Group plc, Finance at Cable & Wireless Communications Plc., Arthur Anderson, Hanson PLC , Tomkins PLC., PC-ICAEW The Institute of Chartered Accountants in England and Wales (ACA), Chartered Institute of Taxation. E-University of Surrey

Lindsay Tomlinson, UK, CB- BlackRock Advisors (UK) Limited. PE-Barclays Global Investors, BZW Asset Management, Provident Mutual, Woolwich Unit Trust Managers Ltd, PC-Chairman of the Code Committee of the Takeover Panel, Limited Chairman of the UK’s National Association of Pension Funds, Investment Management Association-Chair, Financial Reporting Council, National Association of Pension funds-NAPF, Investment Council, E-Cambridge University

Vanguard Group Inc.

Assets management: $2.1 Trillion

F. William McNabb III, US, PC-Investment Company Institute’s Board of Governors. Zoological Society of Philadelphia, United Way of Greater Philadelphia and Southern New Jersey, E- Dartmouth College, M.B.A.-Wharton School of the University of Pennsylvania.

Emerson U. Fullwood, US, CB-Minett Professor at the Rochester Institute of Technology, North Carolina A&T University, SPX Corporation, Amerigroup Corporation, PE-Xerox Corporation, General Signal Corporation, PC-United Way of Rochester, University of Rochester Medical Center, Monroe Community College Foundation, Urban League, Colgate Rochester Crozier Divinity School, E-North Carolina State University, Columbia University-MBA

Rajiv L. Gupta, India-US, CB-New Mountain Capital, Delphi Automotive LLP, Tyco International, Ltd., Hewlett-Packard Company, PE-President-Rohm and Haas Co., Scott Paper Company, Ducolite International, PC-The Conference Board-Trustee, American Chemistry Council, Society of Chemical Industry, Drexel University-Trustee, E- Indian Institute of Technology, Cornell University, Drexel University-MBA

Amy Gutmann Ph.D., US, CB- President of the University of Pennsylvania, PC- Carnegie Corporation of New York, National Commission on the Humanities and Social Sciences. National Constitution Center-Trustee, Presidential Commission for the Study of Bioethical Issues, Global Colloquium of the University Presidents-advisors to the Secretary General of the U.N., E-Harvard-Radcliffe College, London School of Economics, Harvard University-Ph.D. Political Science

JoAnn Heffernan-Heisen, US, CB-Skytop Lodge Corporation, PE-Johnson & Johnson, Primerica Corporation. Kenmill Textile Corporation, Chase Manhattan Bank, PC-Robert Wood Johnson Foundation, University Medical Center at Princeton, Maxwell School of Citizenship and Public Affairs at Syracuse University, Center for Talent Innovation, E- Syracuse University

F. Joseph Loughrey, US, CB-Hillenbrand, Inc., SKF AB, PE- Cummins Inc., PC- National Association of Manufacturers, Kellogg Institute for International Studies at the University of Notre Dame, Chicago Council on Global Affairs, Lumina Foundation for Education, Oxfam America, E-University of Notre Dame,

Mark Loughridge, US, CB-CFO-IBM, IBM’s Retirement Plan Committee, IBM Credit LLC., E-Stanford University, University of Chicago-MBA, Ecole Nationale Superieure de Mecanique in Nantes, France,

Scott C. Malpass, US, CB-Manager-Notre Dame’s $3.5 billion endowment, PE-St. Joseph Capital Corp. The Bank of New York Mellon, Irving Trust Company, PC- Round Table Healthcare Management, LLC., The Investment Fund for Foundations, E-University of Notre Dame-BA-MBA

André F. Perold, US-South Africa, CB-HighVista Strategies, Rand Merchant Bank, PE- Professor of Finance and Banking at the Harvard Business School, Author-The Global Financial System: A Functional Perspective, 1995, E-University of the Witwatersrand, Johannesburg, Stanford University Ph.D.,

Alfred M. Rankin, Jr., US, CB-CEO- NACCO Industries, Goodrich Corp., Hamilton Beach Brands, Inc., The Kitchen Collection, LLC, The North American Coal Corporation, PE-Eaton, McKinsey and Company, Standard Products Co., Reliance Electric Company, PC- National Association of Manufacturers, Federal Reserve Bank of Cleveland-Chairman, E-Yale-BA-JD,

Peter F. Volanakis, US, CB- SPX Corporation, CCS Holding, Inc., PE-CEO-Corning Incorporated, PC-Overseer School of Business Administration at Dartmouth College, E- Dartmouth College-BA-MA,

UBS AG

Assets management: $2.3 Trillion

Axel A. Weber Ph.D., German, PE-German Bundesbank-President, Professor for international economics University of Cologne, Professor for monetary economics Goethe University, PC-European Central Bank, Bank for International Settlements, International Monetary Fund, G7, G20, World Economic Forum-2013, European Systemic Risk Board, Financial Stability Board, German Council of Economic Experts, E-University of Constance, University of Siegen-Ph.D.

Michel Demaré, Belgian, CB-ABB-CFO, Syngenta AG, Global Markets, PE-Baxter International Inc., Dow Chemical Company, Continental Illinois National Bank of Chicago, PC-IMD Foundation, E-Université Catholique de Louvain, Katholieke Universiteit Leuven- Belgium-MBA

David Sidwell, US-UK, CB-Apollo Global Management-AGM LLC, MSCI Inc. Oliver Wyman, PE-Morgan Stanley-CFO, Investment Bank, J.P. Morgan & Co. Inc., PricewaterhouseCoopers, PC-Director of Fannie Mae, National Council on Aging, Federal National Mortgage Association, International Accounting Standards Committee Foundation, E-Cambridge University, Institute of Chartered Accountants in England and Wales

Rainer-Marc Frey, Swiss, CB- Horizon21 AG, DKSH Group, PE-RMF Investment Group-CEO, Man Group plc, Invision Private Equity AG., Salomon Brothers, Merrill Lynch, Capital Dynamics AG, PC-World Economic Forum-2013, Frey Charitable Foundation, Freienbach, E-University of St. Gallen

Ann F. Godbehere, UK-Canada, CB-AllSource Global Management AGM-LLC., Prudential plc, Rio Tinto, Rio Tinto Limited, Atrium Underwriters Ltd., Atrium Underwriting Group Ltd., Arden Holdings Ltd., Bermuda. British American Tobacco plc., PE-Northern Rock-CFO, Swiss Re Group-CFO, Sun Life Financial, Canada) E- Certified General Accountants Association of Canada

Axel P. Lehmann Ph.D., Swiss, Zurich Financial Services, Farmers Group, Inc., PE- Zurich American Insurance Company-CEO, Swiss Life in Zurich, PC-World Economic Forum-2013, International Financial Risk Institute Foundation, Economiesuisse, E- University of St. Gallen, Wharton Advanced Management Program-MBA-Ph.D. Post-grad-Harvard Business School, Arizona State University

Wolfgang Mayrhuber, Austrian, CB-Infineon Technologies AG, Munich Re Group, BMW Group, Lufthansa Technik AG, Austrian Airlines AG., HEICO Corporation, PE- Deutsche Lufthansa AG-CEO, PC-Acatech (Deutsche Akademie der Technikwissenschaften), American Academy of Berlin-Trustee, Technical College in Steyr, Austria, E-Bloor Collegiate Institute in Canada-Mechanical Engineer, Massachusetts Institute of Technology-Management Training

Helmut Panke Ph.D., German, CB-Microsoft Corporation, Singapore Airlines Ltd., Bayer AG., PE-BMW Group-CEO, McKinsey & Company, E- University of Munich, Swiss Institute for Nuclear Research_Ph.D.

William G. Parrett, US, CB-Eastman Kodak Company, the Blackstone Group LP, Thermo Fisher Scientific Inc., PE-Deloitte Touche Tohmatsu-CEO, PC-United States Council for International Business, United Way Worldwide, E-St. Francis College, NY-CPA,

Isabelle Romy Ph.D., Swiss, CB-Law Professor-University of Fribourg, Federal Institute of Technology in Lausanne (EPFL), SIX Swiss Exchange, PE-Swiss Federal Supreme Court, Boalt Hall School of Law, University of California, E- University of Fribourg-Ph.D., University of Lausanne-Law JD,

Beatrice Weder de Mauro Ph.D., Swiss-Italian, CB-Professor of Economics-Johannes Gutenberg University of Mainz, Roche Holding Ltd., Basel, ThyssenKrupp AG, Essen, Deutsche Investitions- und Entwicklungsgesellschaft, Köln, PE-International Monetary Fund (IMF), National Bureau of Economic Research, Centre for Economic Policy Research in London, World Bank, PC-Federal Reserve Board-NY, World Economic Forum 2013, German Council of Economic Experts, E-Cambridge, MA, Harvard University, University of Basel-Ph.D.

Joseph Yam Chi-kwong,, Hong Kong, CB-China Society for Finance and Banking-VP, Advisor- People’s Bank of China, China Construction Bank, Macroprudential Consultancy Limited, Johnson Electric Holdings Limited., PE-Hong Kong Monetary Authority-CEO, PC-Global Economics and Finance at the Chinese University of Hong Kong, Hong Kong Institute of Bankers, China Society for Finance and Banking, E-St. Paul’s College, University of Hong Kong

Luzius Cameron Ph.D., Swiss and Australian, PE-Investment Bank Warburg Dillon Read, Global Rates Business in Zurich, Swiss Bank Corporation, Institute of Astronomy at the University of Basel and European Southern Observatory, E-University of Basel-Ph.D. Astrophysics,

Sergio P. Ermotti, Swiss, CB-CEO-UBS AG, Bayerische Hypo- und Vereinsbank AG, Bank Austria Wohnbau Gewinnscheine. PE-UniCredit, Milan, Bank Polska Kasa Opieki Spolka Akcyjna , Merrill Lynch, Darwin Airline SA, Corner Bank SA, Citibank, BofA Merrill Lynch, PC-London Stock Exchange Group, World Economic Forum 2013, E-Oxford University, Swiss Certified Banking Expert

Bank of America/Merrill Lynch

Assets management: $2.3 trillion

Charles O. Holliday, Jr., US, CB-DuPont Qualicon Inc.-CEO, Royal Dutch Shell plc, CH2M HILL Companies, Ltd, John Deere Credit Company, Pioneer Hi-Bred International Inc., HCA Inc., Lafarge SA., PE-EI DuPont de Nemours & Co.-CEO, Catalyst Inc., PC-The Business Roundtable, World Business Council for Sustainable Development, Business Council, Society of Chemical Industry, International Business Council, National Infrastructure Advisory Council, National Infrastructure Advisory Council, E-University of Tennessee-Engineering,

Susan S. Bies Ph.D., US, CB- Horizon National Corp.-VP, Zurich Financial Services AG, PE- Professor of Economics, Rhodes College Professor of Economics at Wayne State University, PC- Securities and Exchange Commission, Board of Governors of the Federal Reserve System, Federal Reserve Bank of St. Louis, Financial Accounting Standards Board, Financial Executives Institute, End Users of Derivatives Association, American Bankers Association, Bank Administration Institute, American Economic Association, Institute of Management Accountants, International Women’s Forum, American Economic Association, E-State University College at Buffalo, Northwestern University-Ph.D.

Frank P. Bramble, Sr, US, CB-MBNA Corp., Constellation Energy Group Inc., Lecturer-Towson University, PE-Maryland National Bank, MNC Financial Inc., Allfirst Financial Inc., Allfirst Bank-CEO, Allied Irish Banks, p.l.c, Wilmington Trust Retirement and Institutional Services Company, E-Towson University

Arnold W. Donald, US, CB-Atlas Holdings LLC., Wind Point Partners., Russell Brands, LLC, Carnival plc, Crown Holdings, Bridgewell Resources LLC., BJC Health System, Inc., BMO Financial Corp., PE- Monsanto Company-VP, TransCanada Corp.-CEO, Merisant Company-CEO, Tabletop Holdings-CEO, Bank of Montreal, Harris Financial Corporation, Efficas, Inc. Scotts Miracle-gro Co., Belden Inc., The Laclede Group Inc., DHR International, Inc., Oil-Dri Corp., Global Velocity Inc., PC- Boards of Carleton College & Washington University, Grocery Manufacturers of America, United States Russia Business Council, Eurasia Foundation, President’s Export Council, Kennedy School of Government-Dean’s Council, E-Washington University, Carleton College, University of Chicago Graduate-MBA,

Charles K. Gifford, US, CB-FleetBoston Financial Corp.-CEO, Massachusetts Mutual Life Insurance Co., Stone Canyon Venture Partners, LP., CBS Corporation, PE- BankBoston, N.A., PC-Presiding Trustee at NSTAR, Trustee of Northeast Utilities, Trustee of Northeastern University, WGBH Public Broadcasting, E-Princeton University

Monica C. Lozano, US, CB-ImpreMedia, LLC. S, CEO-Publisher-La Opinión L.P., Lozano Communications, Inc., The Walt Disney Co., UnionBanCal Corporation, SunAmerica Asset Management Corporation, PE-Tenet Healthcare Corp., PC-Council on Foreign Relations, Trustee of the University of Southern California, Regent-University of California, California HealthCare Foundation, The Rockefeller Foundation, National Council of La Raza, President’s Council on Jobs and Competitiveness, E-University of Oregon

Thomas J. May, US, CB-CEO-President Northeast Utilities, NSTAR Electric & Gas Corporation, NSTAR Communications, Inc., BEC Funding II, L.L.C., Connecticut Light and Power Company, Public Service Company of New Hampshire, Liberty Mutual Holding Company, Inc., Liberty Financial Companies Inc., New England Business Service Inc., DELUXEPINPOINT, PE-Cambridge Electric Light Company-CEO, Boston Edison Company-CEO, Bankboston Corp., RCN Corporation, PC-Financial Executives International, E-Stonehill College, Bentley College-MS Finance, Harvard Business School’s Advanced Management Program

Brian T. Moynihan, US, CB-CEO-President-BofA, Chairman of Merrill Lynch & Co Inc., General Partner of BofA Merrill Lynch Preferred Capital Trust III, BofA Merrill Lynch Preferred Capital Trust IV, BofA Merrill Lynch Preferred Funding V LP and BofA Merrill Lynch Preferred Funding IV LP, BlackRock Inc., PC-Brown University-Trustee, E-Brown University, University of Notre Dame Law School-JD, Miami University-MA,

Lionel L. Nowell, US, CB-Pepsico, Inc.-VP, Reynolds American Inc., American Electric Power Service Corporation, AEP Texas Central Company, PE-RJR Nabisco, Inc., Diageo PLC, Pillsbury North America-CFO, Pizza Hut, Church & Dwight Co. Inc., Bottling Group, LLC, PC-Executive Leadership Council, Financial Executive Institute, American Institute of Certified Public Accountants, E-Ohio State University

Sharon Allen, US, PE-Deloitte LLP, Deloitte Touche Tohmatsu Limited, Catalyst, Inc., PC-National Board of the YMCA-Chair, President’s Export Council, Women’s Leadership Board at the John F. Kennedy School of Government at Harvard, E- University of Idaho

Jack Bovender, US, CB-HCA Holdings, Inc., HCA Realty, Inc., EP Health, LLC, Montgomery Regional Hospital, Inc., Brookwood Medical Center of Gulfport, VH Holdings Inc. and Women’s and Children’s Hospital, Inc., PE-HCA Inc.-CEO, Tennessee Valley Ventures, L.P. PC-Business Council, Committee for the Preservation of Capitalism, American Hospital Association and the Federation of American Healthcare SystemsDuke University-Trustee, E- Duke University-BA-MA,

Linda Parker Hudson, US, CB-BAE Systems Inc.,-CEO, Tanzania at BAE, PE- General Dynamics Corp., Martin Marietta, Lockheed Martin, Ford Aerospace, Harris Corporation, PC-Aerospace Industries Association-Board, International Women’s Forum and C200 E-University of Florida-Engineering

David Yost, US, CB-AmerisourceBergen Corp.-CEO, Exelis, Inc., Tyco International Ltd., Marsh & McLennan Companies, Inc., HP Enterprise Services, LLC, Aetna Inc., PC- International Federation of Pharmaceutical Wholesalers, University of Pennsylvania-Trustee, E-United States Air Force Academy, University of California at Los Angeles-MBA,

Credit Suisse Group AG

Assets management: $1.8 Trillion

Urs Rohner, Swiss, PE-ProSiebenSat.1 Media AG, Unterfoehring, Lenz & Staehelin, Attorneys at Law, Zurich, Sullivan & Cromwell LLP, New York, PC-Institute for International Finance, World Economic Forum 2013, Institute International d’Etudes Bancaires, E-University of Zurich,

Peter Brabeck-Letmathe, Austrian, CB-Chairman-Nestlé SA L’Oréal SA, Paris, Exxon Mobil Corporation, Delta Topco (Formula 1), PC-World Economic Forum 2013, European Round Table of Industrialists, E-University of World Trade, Vienna.

Jassim Bin Hamad J.J. Al Thani, Qatar, CB-Chairman-Qatar Islamic Bank, QInvest, Damaan Islamic Insurance Co. (BEEMA); Q-RE LLC, CEO-Al Mirqab Capital LLC, Qatar, Qatar Navigation Company, Qatar Insurance Company, Arcapita Bank, Bahrain, E-Royal Military Academy in England.

Iris Bohnet, Swiss, PC-World Economic Forum, Professor of Public Policy at the Harvard Kennedy School, Massachusetts, Academic Dean of the Harvard Kennedy School, Haas School of Business at the University of California at Berkeley, Advisory Board of the Vienna University of Economics and Business Administration, E-University of Zurich

Noreen Doyle, US, CB-Newmont Mining Corporation, QinetiQ Group Plc., Rexam Plc, Macquarie European Infrastructure Fund, Macquarie Renaissance Infrastructure Fund, PE-European Bank for Reconstruction and Development (EBRD) Bankers Trust Company, PC-Women in Banking and Finance in London E-College of Mount Saint Vincent, New York, Dartmouth College-MBA, Marymount International School, London

Jean-Daniel Gerber, Swiss, CP-Lonza Group, Swiss Investment Fund, PC-World Bank Group, World Trade Organization, Economic and Financial Affairs at the Swiss Embassy in Washington D.C. Swiss Swiss Federal Council to State Secretary, State Secretariat for Economic Affairs, Swiss Federal Office of Migration (1994 to 2004), E-University of Berne, Switzerland,

Walter B. Kielholz, Swiss, CB- Corsair Capital Ltd. Avenir Suisse, PE-General Reinsurance Corporation, Zurich, PC-World Economic Forum 2013 International Business Council, European Financial Services Roundtable, Monetary Authority of Singapore, Advisory Council of the Mayor of Shanghai, Credit Suisse Research Institute, E-University of St. Gallen, Switzerland,

Andreas N. Koopmann, Swiss, CB-Georg Fischer AG, CSD Group, Nestlé SA, Alstom (Suisse) SA, PE-Bobst Group S.A., Swiss Federal Institute of Technology, International Institute for Management Development (IMD), PC-Swissmem—Association of Swiss Mechanical and Electrical Engineering Industries

Jean Lanier, French, PE-Euler Hermes, Pargesa Group Lambert Brussells Paribas Group, PC-La Fondation Internationale de l’Arche, Ecole Centrale des Arts et Manufactures, Paris, E-Cornell University, Awards-Chevalier de la Légion d’Honneur in France

Kai S. Nargolwala, Singapore, CB-Singapore Telecommunications Ltd, Prudential Plc., Clifford Capital Pte. Ltd, Duke-NUS Graduate Medical School of Singapore, PE-Bank of America, Peat Marwick Mitchell & Co., E-University of Delhi,

Anton van Rossum, Dutch, CB-Fortis, Royal Vopak NV, Solvay SA PE- McKinsey and Company, PC-Netherlands Economics Institute, American European Community Association, European Roundtable of Financial Services, E-Erasmus University-BA-MBA

Richard E. Thornburgh, US, CB-Corsair Capital, Credit Suisse First Boston, Reynolds American Inc., Winston-Salem, McGraw-Hill, New Star Financial Inc., PE-First Boston Corporation, E-University of Cincinnati, Harvard Business School-MBA Finance

John Tiner, UK, CB-Lucida plc, Friends Life, Corsair Capital, PE-FSA, PC-Committee of European Insurance and Occupational Pensions Regulators, European Securities Regulators E-Kingston University, Awards-2008-Commander of the British Empire

Allianz SE (Owners of PIMCO)

Assets Management; $ 2.3 Trillion

and

PIMCO-Pacific Investment Management Company

Assets Management; $1.8 Trillion

Michael Diekmann, German, CB-Allianz SE (CEO) Siemens AG, BASF Wall Systems Inc., Lufthansa AG PE- Dresdner Bank AG, Linde AG, BASF SE., Riunione Adriatica Di Sicurta Spa, PC-World Economic Forum 2013, Geneva Association; European Financial Services Round Table (EFR), EVIAN (Franco-German Roundtable), International Business Leaders Advisory Council for the Mayor of Shanghai (IBLAC), Pan-European Insurance Forum (PEIF), Stifterverband für die Deutsche Wissenschaft, Monetary Authority of Singapore (MAS), E-Göttingen University

Oliver Bäte, German, CB-Allianz SE-CFO, PE-Westdeutsche Landesbank, McKinsey & Company, New York, Professor at University of Cologne, German Air Force, PC- Chairman of CFO Forum, E-University of Cologne, New York University-MBA.

Manuel Bauer, German, PE-Zagrebacka Banka D.D., Bajaj Allianz Life Insurance Company Ltd., ROSNO Group, E-Technical Engineering College-Vienna.

Gary C. Bhojwani, India, PE-Intercargo Corporation & Intercargo Insurance; Trade Insurance Services, Avalon Risk Management-CEO, Fireman’s Fund Insurance Company, Lincoln General Insurance Company-CEO, E-University of Illinois at Champaign-Urbana, University of Chicago-MBA.

Clement B. Booth, South Africa, CB-ACORD Corporation, PE- Chairman and CEO, Aon Re International, London, PC-Director of Association of British Insurer, E- University of Witwatersrand Business School-Executive Development Program

Dr. Helga Jung, German, CB-UniCredit S.p.A. PE-Professor at the University of Augsburg, E-University of Augsburg, Administration Doctorate.

Christof Mascher JD, Austrian, E-University of Vienna, University of Innsbruck-Doctorate Law.

Jay Ralph, US, PE-Arthur Andersen & Company, Northwestern Mutual Life Insurance Company, Centre Re Bermuda Ltd., Zurich Re, Fireman’s Fund Insurance Company. E- University of Wisconsin, University of Chicago-MBA Finance.

Dieter Wemmer Ph.D., Hope you are doing well.

Werner Zedelius Ph.D., German, CB-Europe General Insurance-CFO, PE-Zurich Financial Services AG-CFO, Zurich Re, Agrippina, Zurich Versicherung Aktiengesellschaft, Oxford, PC-Economiesuisse E-University of Cologne-Ph.D. Mathematics.

Maximilian Zimmerer Ph.D., German, CB-Allianz Dresdner Bauspar AG, Allianz Immobilien GmbH and Hauck & Aufhäuser Banquiers Luxembourg S.A., PE-Dresdner RCM Global Investor, Landesbank Baden-Wuerttemberg, PC-Federal Finance Ministry, World Economic Forum 2013, German Equity Institute, Bundesanstalt für Finanzdienstleistungsaufsicht (Federal Security Authority) E-University of Cologne-Law.

________________________________________

Peter Phillips is professor of sociology at Sonoma State University and president of Media Freedom Foundation/Project Censored. Brady Osborne is a senior level research associate at Sonoma State University.

Sonoma State University’s Kimberly Soeiro, Katelyn Clatty, and Garrett Lyons provided research assistance with this study. Portions of the literature review in this chapter were previously published in earlier Censored yearbooks.

This article is a Chapter from the Newest Book Project Censored Project Censored 2014: Fearless Speech in Fateful Times

By Peter Phillips and Brady Osborne